Blog

Monday

17

OCTOBER

2016

Mortgage Rule Changes and what they mean to Manitoba Home Buyers

The Federal Government announced that, effective October 17th, there will be new mortgage rules put in place to ensure the stability of the housing market if interest rates were to rise. These measures are being taken to cool the Vancouver and Toronto housing markets, slow down consumer spending and ensure homebuyers are not going to suffer with payment shock should their mortgage renew into a higher interest rate. These safeguards are meant to protect the financial security of Canadians as well as the stability of the housing market. Here is a brief outline of some of the changes:

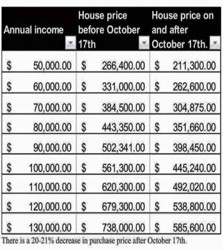

Mortgage Rate Stress Test on All Insured Mortgages – this means that all insured mortgages, fixed or variable and regardless of term, where a buyer has less than a 20% down payment, will now have to qualify at the Bank of Canada’s 5 year benchmark rate. This rate is currently 4.64%. For a first time home buyer this will mean roughly a 2% difference at which they need to qualify and an approximate 20% reduction in the amount of mortgage money available to purchase a home. See photo above.

Restricted Insurance for Low-Ratio Mortgages – there is new criteria for home owners getting low-ratio/conventional mortgages to meet. These include a maximum amortization of 25 years, a maximum GDS/TDS of up to 39/44%, a purchase price not exceeding $1,000,000 and a minimum beacon score of 600. *Changes to low-ratio/conventional mortgage eligibility will become effective November 30, 2016.

Homeownership is not only a goal for most of us, but also a way to build equity towards retirement as well as to invest in our personal wealth. Now more than ever Manitoba home owners should be relying on the advice of a Mortgage Professional to guide them through these new changes. If you are thinking of buying a new home within the next five years, now is the time to seek advice about your financial future. Taking the time to educate yourself now will put you on the right track to homeownership. This includes not taking on any unsecured debt without first consulting your financial advisor and mortgage professional about how it could impact your home buying dreams.

For more information on these Mortgage Rule Changes and how they affect you, please contact one of our trusted and knowledgeable Mortgage Professionals at One Link Mortgage.