Blog

Wednesday

14

FEBRUARY

2018

Winnipeg Mortgage Brokers - Raising Your Credit Score

Winnipeg Mortgage Brokers - Raising Your Credit Score

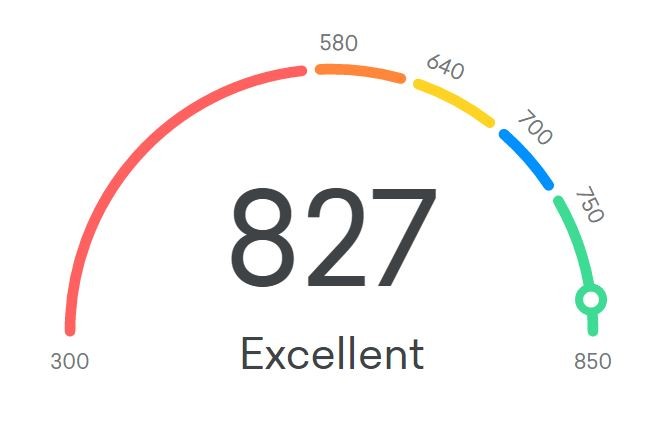

Your credit score has a significant impact on whether or not you will be approved for the mortgage you need to purchase your new home.

If your mortgage pre-approval or application have been denied because of your credit score, you know first-hand the importance of knowing your credit score and making sure it is as high as it can possibly be. There are some cases where you may be able to qualify for assistance with your down payment or for a low to now down payment mortgage, but those typically come with certain disadvantages like mortgage insurance requirements.

In this type of situation, your best bet is to work at raising your credit score as much as you can before you apply (again) for your home loan.

The very first step in the process of raising your credit score is finding out what it is. Knowing your score gives you something more concrete to work with and understanding your credit report can help you make sure your credit report is accurate. If you do find information on your credit report that is not correct, you will need to work to get that fixed as soon as possible. Having incorrect information removed from your credit can lead to a decent boost in your score, at no cost to you.

Once you have checked that your credit is accurate, figure out exactly where you need to make improvement and make a plan to accomplish these improvements. This plan may look something like:

1. Catch up on late payments

2. Finish paying any accounts that have gone into collections

3. Open a credit card (A secured card may be the only option in the beginning)

Now that you have begun working on your credit, it is also important that you are not making it any worse. Keep your credit card balances low and avoid opening up too many new accounts as these can both count against you where your credit is concerned.

If you have questions about your credit and how it is affecting your mortgage options, give us a call today! One of our experienced Winnipeg mortgage brokers will be more than happy to help you plan for your financial future.